Looking to gain an advanced understanding of valuation and merger & acquisition (M&A) techniques?

How companies are valued can be a bit of a mystery to entrepreneurs who have not sold a business previously – with enterprise value, capitalized earnings, discounted cash flow, EBITDA multiples, synergistic premiums, working capital pegs, and other factors complicating the mix.

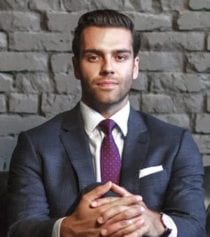

During this previously-recorded webinar, Kevin Shaw – Senior Vice President at Renaissance Mergers & Acquisitions – explains the art and science of valuation so that you can embark on a sale process with a value expectation based on appropriate valuation concepts. After watching this presentation, viewers will have a clear understanding of current market trends, exit readiness, types of transactions, valuation, deal structure, the selling process, fees, and typical challenges that accompany an M&A transaction.