ABOUT TEC CANADA’S CEO CONFIDENCE INDEX

Each quarter, TEC Canada surveys members who are CEOs, key executives, and business owners of predominantly small-to-medium enterprises with employees primarily between 50 to 500 and annual revenue of between $1 million to $500 million. The results are then analyzed by Dr. Peter Andersen, the former assistant chief of the Bank of Canada’s research department.

WHY IT MATTERS

By measuring the real-time pulse and sentiments of these Canadian business leaders, TEC Canada’s CEO Confidence Index provides a data-driven overview of the existing economic, market and sector developments and serves as an early indicator of trends in employment, capital spending, sales, earnings, and profit expectations across the country. This can help you anticipate turning points in economic activity and be leveraged to make informed decisions about your business’s future. With TEC Canada’s CEO Confidence Index, you’ll have a clear picture of the business landscape and be better prepared to navigate whatever comes your way.

Unlike other business outlook surveys that only include the largest firms in Canada, our CEO Confidence Index digs deep into what is happening in various provinces, revealing regional trends and providing a unique insight into the challenges and opportunities that matter most to our members.

Highlights

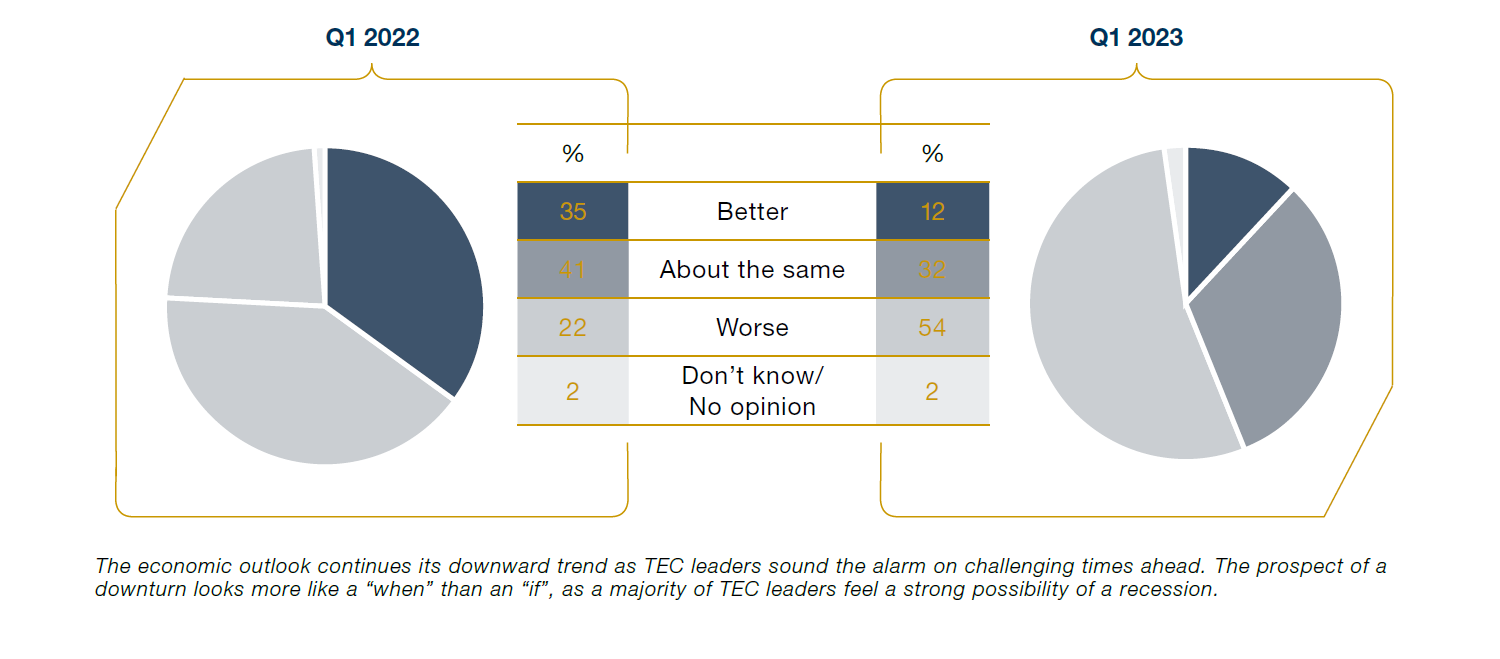

504 CEOs were polled with the question: During the next 12 months, do you expect overall economic conditions in Canada will be better, about the same, or worse than now?

“While there was not a recession in 2022, it was a year of underperformance for the general economy, and the TEC leaders surveyed think that 2023 will be even more challenging.” – Dr. Peter Andersen

Featured Insights

Our latest survey tells us that a growing majority of TEC CEOs (64%) now believe that a recession is either a certainty or highly likely. This is up from 58% in our previous survey. Only 2% think that there is a low chance of a recession. The warning signal is flashing red. This is a big difference from the message a year ago. As last year began, the balance of opinion on the outlook for 2022 was solidly positive, with 35% expecting economic conditions to improve, and only 23% expecting them to worsen.

Rising interest rates are having a disruptive effect. The majority of respondents (52%) say that current interest rate levels are already having a negative impact on their business. This is up sharply from 40% in our previous survey. Another 29% say that while the latest rate increases have not had a negative effect on their business, any further rate increases would.

Inflation is having a more pronounced impact on hiring strategy. Rising business input costs are having an impact on active recruiting. They have already caused 20% of our respondents to cut back. Another 25% will cut back on hiring if costs continue to rise. These percentages are rising. Three months ago, only 11% had cut back.

While hiring plans are shifting, layoffs are not a big issue. TEC leaders know how hard it has been to hire and retain workers. Only a small percentage are currently undertaking layoffs (8%) or are considering them (11%). A large percentage (75%) have no plans to lay off workers, about the same as in our previous survey. Looking ahead over the next 12 months, only 9% on our survey expect a reduction in their firms’ total number of employees. This percentage is unchanged from our previous survey. The percentages expecting employment levels to increase (50%), or remain the same (39%), are also basically unchanged.

The full report contains even more insights about Pricing, Sales & Profitability, Supply Chain Shifts, and Regional Insights. Download it here.

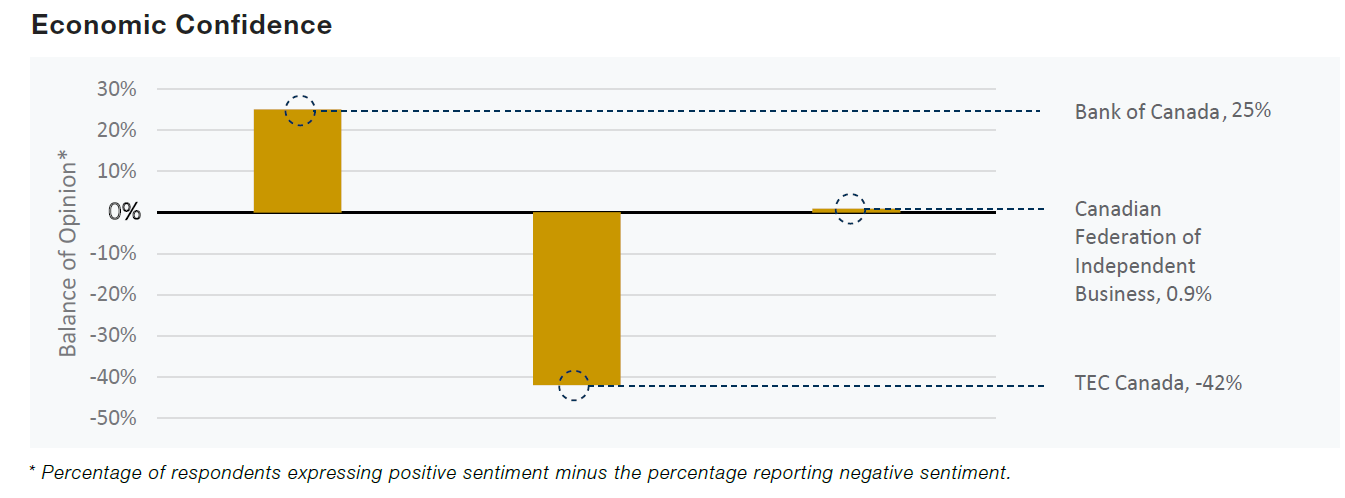

Confidence Comparison

TEC Canada, the Bank of Canada, and the CFIB

Economic analysis rarely exists in a vacuum. Local and national affairs are interconnected, and insights should always be viewed in context. To explore similarities and differences in perspectives on the Canadian economy, we have compared the results of the Q1 report to the most recent Bank of Canada Business Outlook study and the CFIB Monthly Business Barometer.

Questions to Consider

About Dr. Peter Andersen

Dr. Peter Andersen is an independent consulting economist specializing in economic forecasting. He obtained his doctorate in economics from Harvard University. Early in his career he was Assistant Chief of the Bank of Canada’s Research Department where he advised the Governor and Bank of Canada management on economic conditions and the economic outlook. Later as a partner with a national management consulting firm, Andersen was an economic consultant and advisor to a wide range of companies. He has always emphasized communication and the need to put economic analysis into terms that are useful for business decision-making. Dr. Andersen also spent several years with several major Bay Street investment dealer firms before founding Andersen Economic Research Inc. His clients are widely distributed across a broad range of corporations and financial institutions throughout North America. His objective is to act as a filter, separating the signals from the noise, in order to provide clients with the useful information that they really need. In his consulting practice, he provides strategic economic advice to senior management through boardroom meetings, video conferencing, email commentary, conference calls and the monthly Andersen Economic Report.

Download the Report

Unlike other business outlook surveys that only include the largest firms in Canada, our CEO Confidence Index digs deep into what is happening in various provinces, revealing regional trends and providing a unique insight into the challenges and opportunities that matter most to our members.