CEO Confidence Index | Q2 2024

Your access to the minds and insights of leaders from small and medium-sized businesses with a median annual revenue of $5 to $50 million.

In this edition:

Key Insights

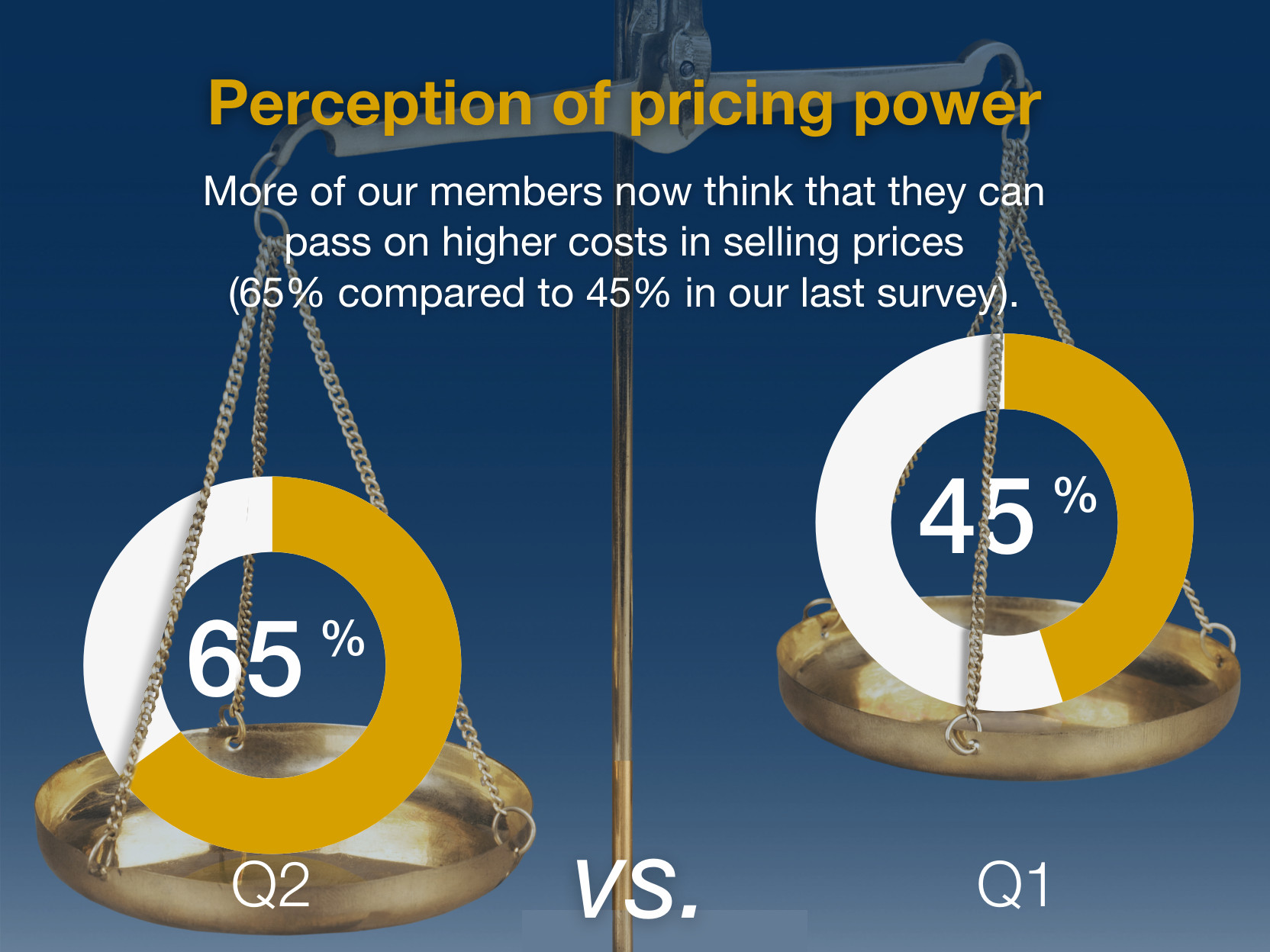

The key question for everyone now is, “where is inflation headed”. The answer will determine tomorrow’s interest rates, and the economy’s performance. In past surveys, TEC CEOs indicated that they had significant pricing power. Economic conditions were difficult, but there was a general belief that costs could be passed on in selling prices. Inflation expectations were elevated last year.

There is no doubt that confidence in the economy is still slumping. Many respondents (45%) still report that economic conditions have worsened over the past 12 months. Only 23% expect them to improve over the next 12 months. This is not as bad as before though. In our previous survey, 63% said that business conditions had worsened, and fewer (14%) expected an improvement. In Quebec and BC in our 2nd Quarter survey, the balance of opinion (better vs worse) is still negative on the outlook, but there has been an improvement. Fortunately, we can now say that TEC member confidence has bottomed, and has improved slightly.

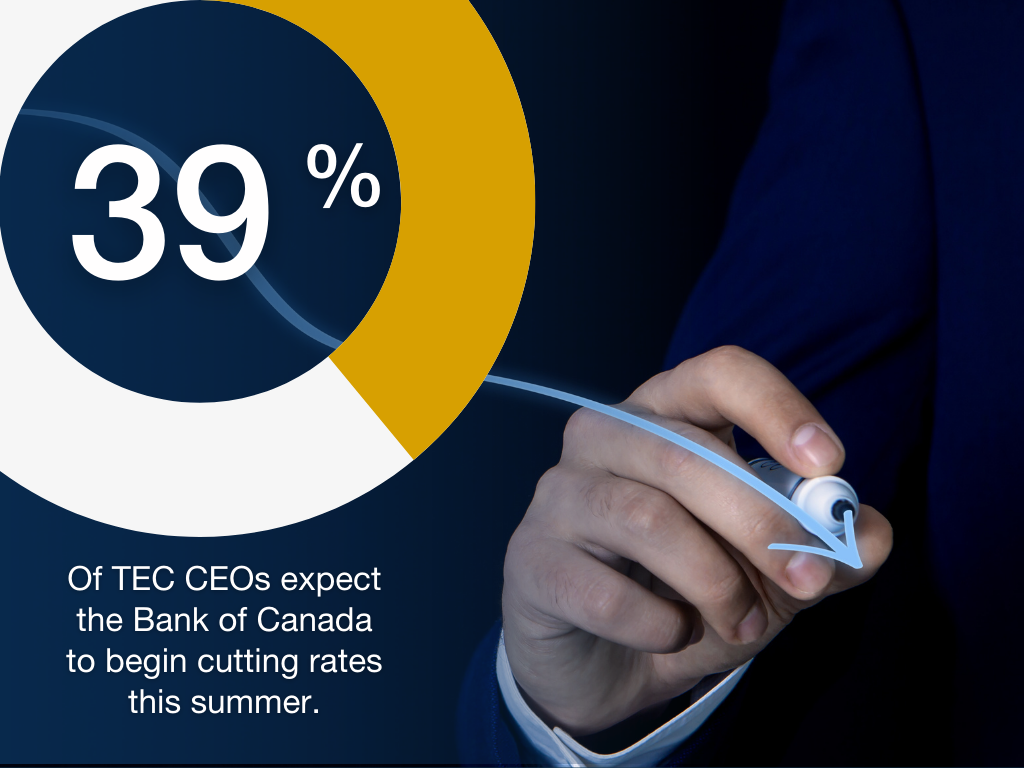

Expected economy-wide inflation, looking 1-year ahead, is now clustered in the 3% range. This could be a problem, as inflation expectations of 3% to 4% are not compatible with the official inflation target and the hope for lower interest rates. Despite this inflation projection, most respondents expect the Bank of Canada to begin cutting rates, either this summer or in the fall of 2024.

The majority of TEC respondents expect their firm’s productivity to improve. Nonetheless, there is still a sizeable percentage that expects their firm’s productivity to remain unchanged. There are 4 main reasons holding back productivity improvement. They are availability of skilled or specialized talent, cost of labour or materials, the regulatory environment and government policy restraint, and finally, scale of operations and market size limitations.

The majority of TEC respondents expect their firm’s productivity to improve. Nonetheless, there is still a sizeable percentage that expects their firm’s productivity to remain unchanged. There are 4 main reasons holding back productivity improvement. They are availability of skilled or specialized talent, cost of labour or materials, the regulatory environment and government policy restraint, and finally, scale of operations and market size limitations.

Q2 2024 TEC CANADA CEO CONFIDENCE INDEX:

Visualizing Perspectives

Download the Full Report

Unlike other business outlook surveys that only include the largest firms in Canada, our CEO Confidence Index digs deep into what is happening in various provinces, revealing regional trends and providing a unique insight into the challenges and opportunities that matter most to leaders of Canadian SMEs.

About Dr. Peter Andersen

Dr. Peter Andersen is an independent consulting economist specializing in economic forecasting. He obtained his doctorate in economics from Harvard University. Early in his career he was Assistant Chief of the Bank of Canada’s Research Department where he advised the Governor and Bank of Canada management on economic conditions and the economic outlook. Later as a partner with a national management consulting firm, Andersen was an economic consultant and advisor to a wide range of companies. He has always emphasized communication and the need to put economic analysis into terms that are useful for business decision-making. Dr. Andersen also spent several years with several major Bay Street investment dealer firms before founding Andersen Economic Research Inc. His clients are widely distributed across a broad range of corporations and financial institutions throughout North America. His objective is to act as a filter, separating the signals from the noise, in order to provide clients with the useful information that they really need.