About TEC Canada’s CEO Confidence Index

Every quarter, we survey TEC Canada members who are CEOs, KEY Executives, and business owners of small-to-medium enterprises*. The results are then analyzed by Dr. Peter Andersen, the former assistant chief of the Bank of Canada’s research department.

*With employees primarily between 50 to 500 and annual revenue of between $1 million to $500 million.

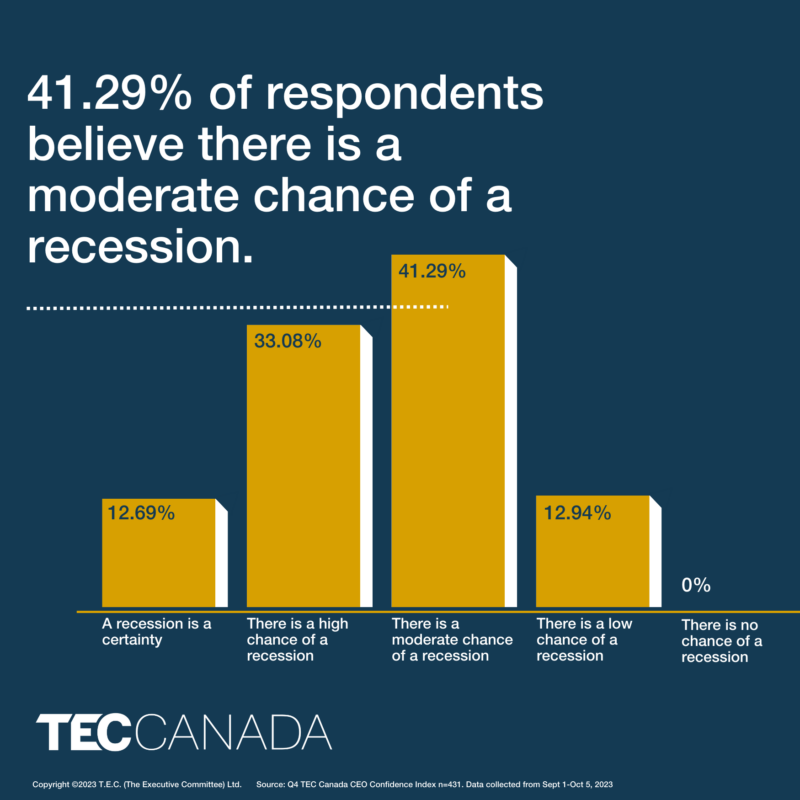

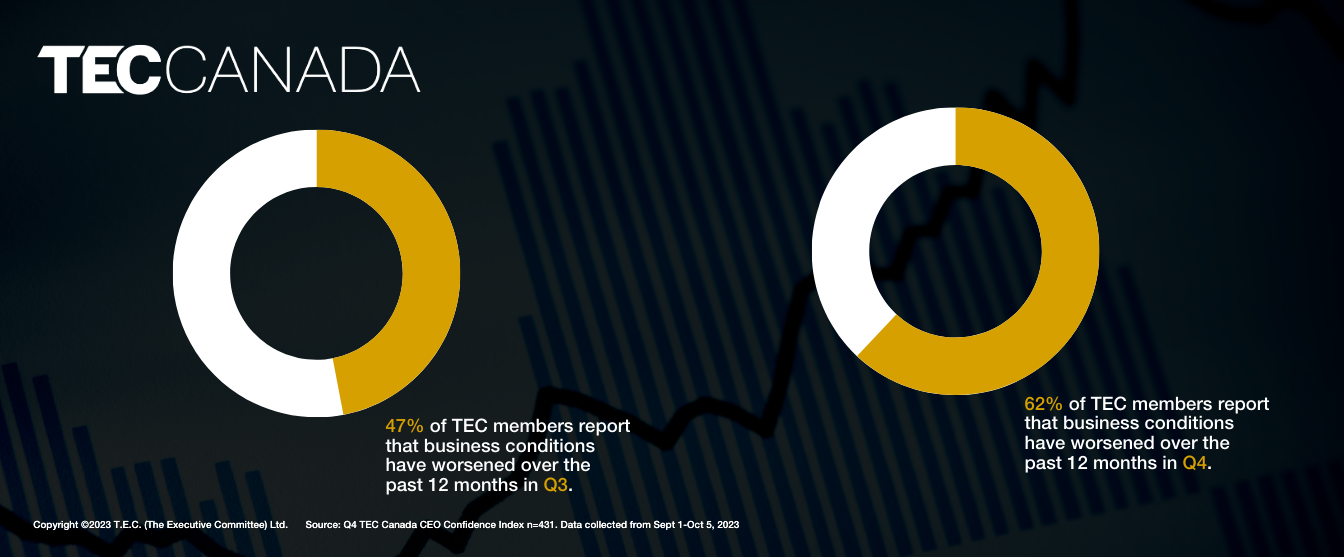

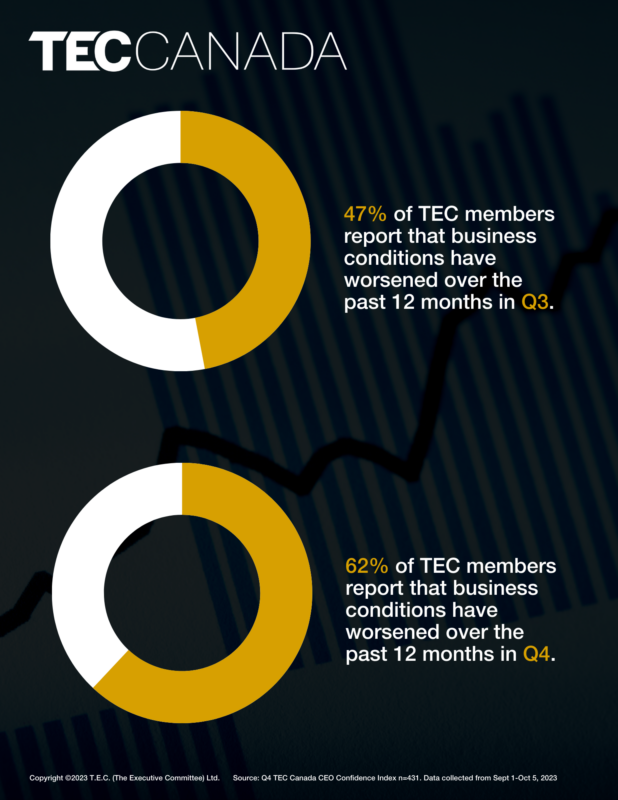

TEC Canada members react fast to new opportunities, but high interest rates and stricter credit conditions are challenging for them. Small businesses face challenges in obtaining loans. As a result, they are more vulnerable to the risks associated with rising interest rates and tightening credit conditions. Our latest CEO survey shows how TEC Canada members are coping with these challenges.

Participation in the CEO survey is encouraging with over 400 responses, consistently at 25% for the past year. Such a large sample provides meaningful results. The survey ended on October 5th and reveals that TEC Canada members think business conditions are now tougher.

The TEC Canada CEO Confidence Index collects real-time pulse and sentiment data from Canadian business leaders. This CEO survey gives information about the economy, market, and sectors. It can show trends in employment, spending, sales, earnings, and profits in the country. By using this information, you will be more informed about projected changes in the economy and be equipped to make more informed decisions for your business’s future.

Highlights

Featured Insights

Technology continues to advance at an unprecedented rate, and today’s CEOs are more cognisant of the opportunities it presents. A majority (68%) of CEO’s anticipate that artificial intelligence (AI) will have an impact on their business operations. In a surprising twist, AI is expected to have a positive impact on the job market. 48% of respondents expressed their intentions to provide AI training to their current employees and 10% will consider the recruitment of individuals who are skilled in AI.

Even amongst these technological shifts, a majority (89%) of employers have stated that their company’s employment levels will either increase, or remain stable. This optimistic outlook aligns with the latest data from Statistics Canada, which indicates an employment rate increase of 63,800 in September compared to the previous month.

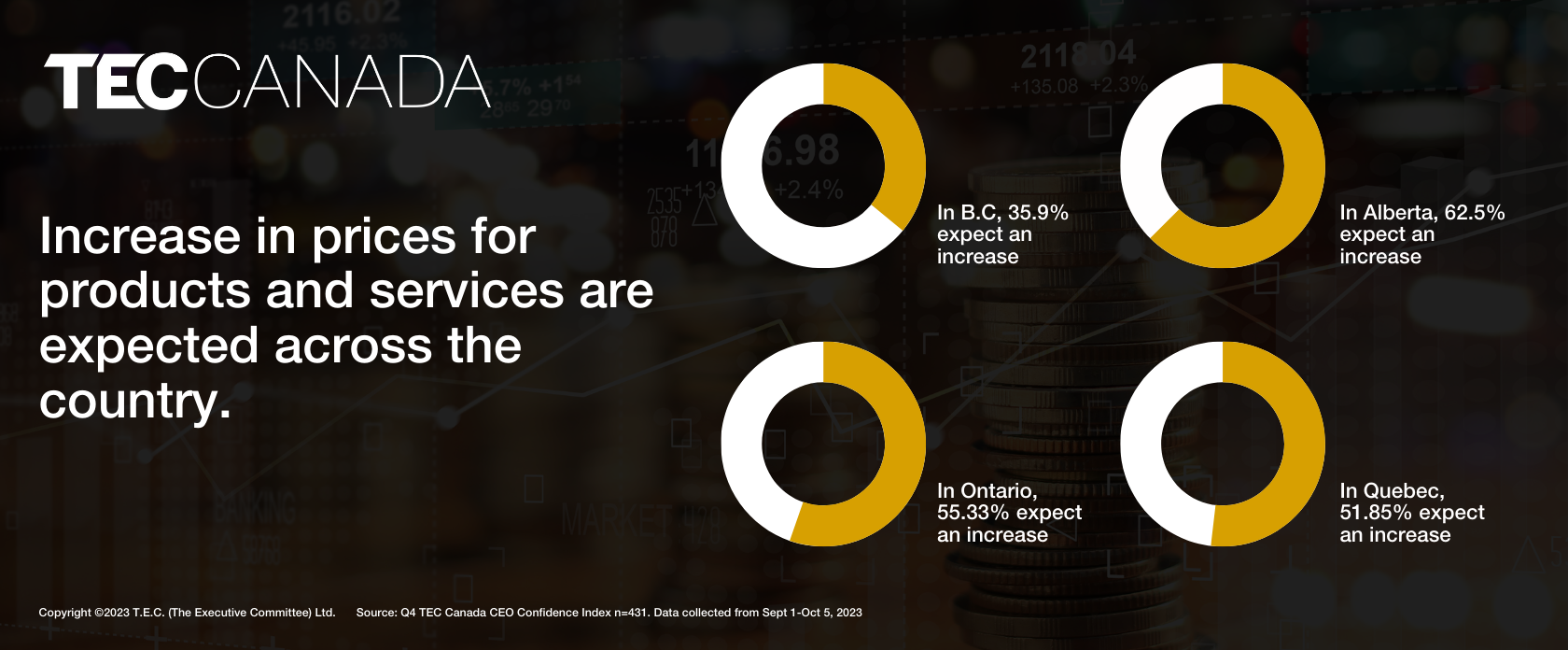

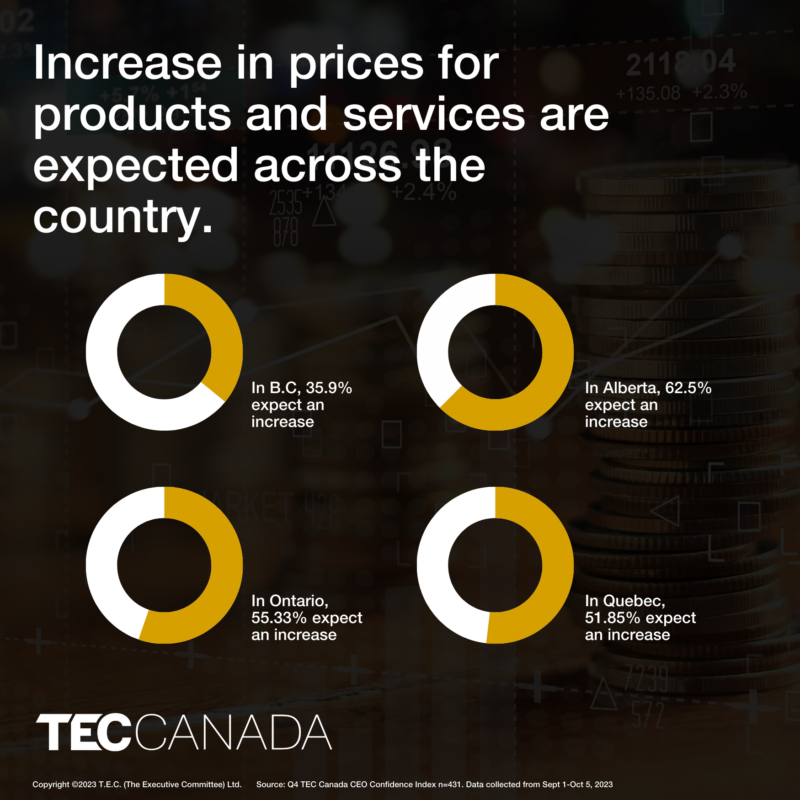

In response to unfavourable economic conditions, including a weaker economy, higher interest rates, and tighter credit conditions, the outlook for firm profitability appears to be bleak. A significant portion of respondents, totaling 66%, now anticipate that their future profits will either remain stagnant or decline. This shift in profit expectations is driven by the combined pressures of a weakened economy and escalating operation costs, despite 54% of firms planning to raise prices for their products and services.

On a more positive note, despite this challenging economic landscape, 71% of respondents have stated that they do not intend to implement layoffs within their organizations. Furthermore, 42% of respondents do not expect to cut back on hiring. These perspectives on employment are impressive, considering that a majority of businesses have reported adverse effects stemming from current interest rate conditions.

In a tight-resource environment, small and medium-sized businesses may encounter challenges in retaining talent and increasing productivity without incurring substantial costs. A way to address these issues is to prioritize employee engagement. A Gallup-meta analysis found that businesses with higher levels of employee engagement outperform their peers in profitability, productivity, and turnover.

In a tight-resource environment, small and medium-sized businesses may encounter challenges in retaining talent and increasing productivity without incurring substantial costs. A way to address these issues is to prioritize employee engagement. A Gallup-meta analysis found that businesses with higher levels of employee engagement outperform their peers in profitability, productivity, and turnover.

Conducting a survey is a great starting point to gain insights on what needs to be done to elevate employee engagement. As well, establishing a strong alignment between employees’ personal values and goals and the organization’s mission is also a key part of increasing engagement. This alignment can be achieved through strategic interviews aimed at assessing the fit between individual and company. Furthermore, assigning tasks that resonate with the employee’s strengths, values, and interests can also encourage loyalty, engagement, and productivity.

If you would like to learn more on the role employee engagement plays in building productivity, click here to watch TEC Canada’s webinar on Navigating the Talent Gap featuring TEC speaker Eddie LeMoine.

Technology continues to advance at an unprecedented rate, and today’s CEOs are more cognisant of the opportunities it presents. A majority (68%) of CEO’s anticipate that artificial intelligence (AI) will have an impact on their business operations. In a surprising twist, AI is expected to have a positive impact on the job market. 48% of respondents expressed their intentions to provide AI training to their current employees and 10% will consider the recruitment of individuals who are skilled in AI.

Even amongst these technological shifts, a majority (89%) of employers have stated that their company’s employment levels will either increase, or remain stable. This optimistic outlook aligns with the latest data from Statistics Canada, which indicates an employment rate increase of 63,800 in September compared to the previous month.

In response to unfavourable economic conditions, including a weaker economy, higher interest rates, and tighter credit conditions, the outlook for firm profitability appears to be bleak. A significant portion of respondents, totaling 66%, now anticipate that their future profits will either remain stagnant or decline. This shift in profit expectations is driven by the combined pressures of a weakened economy and escalating operation costs, despite 54% of firms planning to raise prices for their products and services.

On a more positive note, despite this challenging economic landscape, 71% of respondents have stated that they do not intend to implement layoffs within their organizations. Furthermore, 42% of respondents do not expect to cut back on hiring. These perspectives on employment are impressive, considering that a majority of businesses have reported adverse effects stemming from current interest rate conditions.

In a tight-resource environment, small and medium-sized businesses may encounter challenges in retaining talent and increasing productivity without incurring substantial costs. A way to address these issues is to prioritize employee engagement. A Gallup-meta analysis found that businesses with higher levels of employee engagement outperform their peers in profitability, productivity, and turnover.

Conducting a survey is a great starting point to gain insights on what needs to be done to elevate employee engagement. As well, establishing a strong alignment between employees’ personal values and goals and the organization’s mission is also a key part of increasing engagement. This alignment can be achieved through strategic interviews aimed at assessing the fit between individual and company. Furthermore, assigning tasks that resonate with the employee’s strengths, values, and interests can also encourage loyalty, engagement, and productivity.

If you would like to learn more on the role employee engagement plays in building productivity, click here to watch TEC Canada’s webinar on Navigating the Talent Gap featuring TEC speaker Eddie LeMoine.

Download the Report

Unlike other business outlook surveys that only include the largest firms in Canada, our CEO Confidence Index digs deep into what is happening in various provinces, revealing regional trends and providing a unique insight into the challenges and opportunities that matter most to TEC Canada members. Download our latest CEO survey now!

About Dr. Peter Andersen

Dr. Peter Andersen is an independent consulting economist specializing in economic forecasting. He obtained his doctorate in economics from Harvard University. Early in his career he was Assistant Chief of the Bank of Canada’s Research Department where he advised the Governor and Bank of Canada management on economic conditions and the economic outlook. Later as a partner with a national management consulting firm, Andersen was an economic consultant and advisor to a wide range of companies. He has always emphasized communication and the need to put economic analysis into terms that are useful for business decision-making. Dr. Andersen also spent several years with several major Bay Street investment dealer firms before founding Andersen Economic Research Inc. His clients are widely distributed across a broad range of corporations and financial institutions throughout North America. His objective is to act as a filter, separating the signals from the noise, in order to provide clients with the useful information that they really need.