Key Insights | TEC Canada CEO Confidence Index | Business Outlook Survey Q2 2024

The key question for everyone now is, “where is inflation headed”. The answer will determine tomorrow’s interest rates, and the economy’s performance. In past surveys, TEC CEOs indicated that they had significant pricing power. Economic conditions were difficult, but there was a general belief that costs could be passed on in selling prices. Inflation expectations were elevated last year.

There is no doubt that confidence in the economy is still slumping. Many respondents (45%) still report that economic conditions have worsened over the past 12 months. Only 23% expect them to improve over the next 12 months. This is not as bad as before though. In our previous survey, 63% said that business conditions had worsened, and fewer (14%) expected an improvement. In Quebec and BC in our 2nd Quarter survey, the balance of opinion (better vs worse) is still negative on the outlook, but there has been an improvement. Fortunately, we can now say that TEC member confidence has bottomed, and has improved slightly.

Supply chain shortages of non-labour inputs are not a problem for a large majority of respondents (74%). Workers are not as hard to find. Only 16% now report that it is more difficult to fill jobs. This is down from 21% in our 1st Quarter business outlook survey.

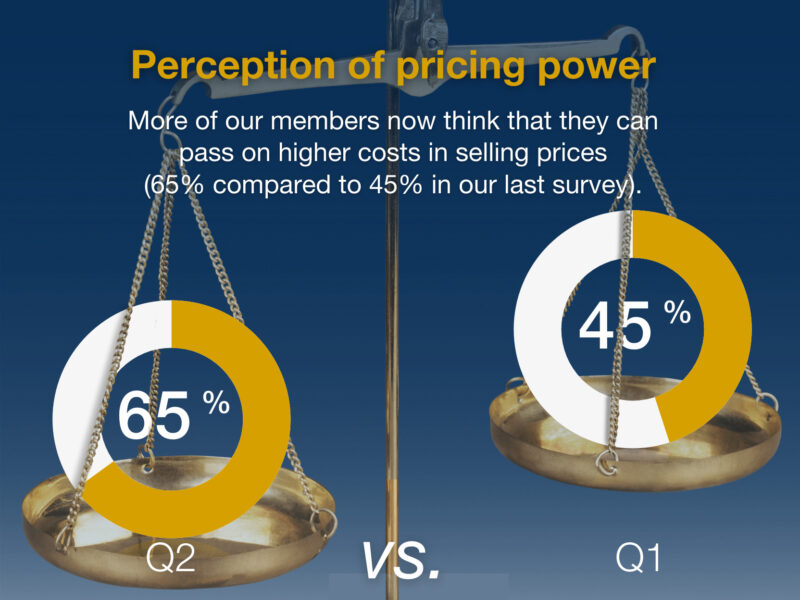

There is a pronounced inflation mindset though. There is still a perception of pricing power. More TEC Canada members now think that they can pass on higher costs in selling prices (65% compared to 45% in our last survey). However, there are qualifications.

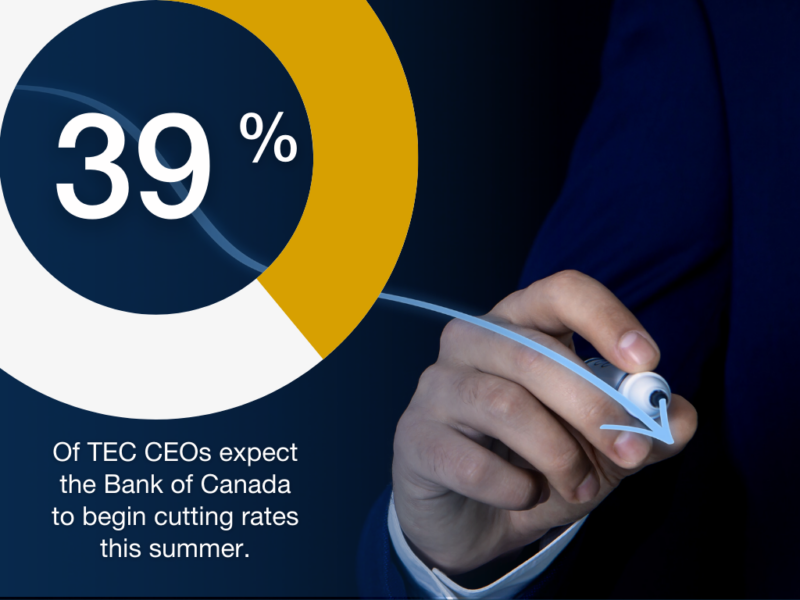

Within that 65%, the number saying that their ability to pass on costs has lessened, and outnumber by 3 to 1 those saying that it has become easier to pass them on. Expected economy-wide inflation, looking 1 year ahead, is now clustered in the 3% range (57% of respondents). This is unchanged from our previous survey. The next most likely level is 4% inflation (25% of respondents). This could be a problem, as inflation expectations of 3% to 4% are too high. They are not compatible with the official inflation target and the hope for lower interest rates. Despite this inflation projection, most TEC Canada CEOs expect the Bank of Canada to begin cutting rates, either this summer (39%) or in the fall of 2024 (33%). Some even still expect rate cuts before mid-year 2024. Relatively few expect rate cuts to be delayed until 2025 or later (13%).

Compared to the last survey, these expectations are more positive. Hiring intentions have held up, with 88% of TEC Canada members now planning on an increase or no change in payrolls. A lower percentage now plans to cut employment. There is also a higher reading now for the expected increase in sales revenues. In addition, the outlook for business investment and profitability has stayed upbeat.

To summarize, 45% plan to increase employment over the next 12 months. Only 11% expect to reduce employment. Fewer TEC Canada members are now considering or undertaking layoffs, compared to 3 months ago (25% compared to 29%). However, layoffs are still an issue in BC, where 33% are either considering them or actually undertaking them. This is the same percentage for BC as in the 1st Quarter survey.

More expect to increase business investment (33%), than reduce it (20%). More expect their firm’s profitability will improve (37%) than worsen (25%). The majority (52%) expect their firm’s sales revenue volumes to increase during the next 12 months.

Alberta and Ontario respondents are even more optimistic about the outlook for their firms’ revenue volumes. In Alberta, 58% of TEC CEOs expect an increase, and in Ontario, 54% expect an increase.

Download the Full Report

Unlike other business outlook surveys that only include the largest firms in Canada, our CEO Confidence Index digs deep into what is happening in various provinces, revealing regional trends and providing a unique insight into the challenges and opportunities that matter most to leaders of Canadian SMEs.

About Dr. Peter Andersen

Dr. Peter Andersen is an independent consulting economist specializing in economic forecasting. He obtained his doctorate in economics from Harvard University. Early in his career he was Assistant Chief of the Bank of Canada’s Research Department where he advised the Governor and Bank of Canada management on economic conditions and the economic outlook. Later as a partner with a national management consulting firm, Andersen was an economic consultant and advisor to a wide range of companies. He has always emphasized communication and the need to put economic analysis into terms that are useful for business decision-making. Dr. Andersen also spent several years with several major Bay Street investment dealer firms before founding Andersen Economic Research Inc. His clients are widely distributed across a broad range of corporations and financial institutions throughout North America. His objective is to act as a filter, separating the signals from the noise, in order to provide clients with the useful information that they really need.