The inflation rate is the highest we have seen in 40 years—you’re right to think it’s not business as usual. Indiscriminate in nature, inflation affects everything from real estate to grocery stores. As a significant driver of business closure, leaders everywhere must learn how to prepare their organizations for the impact of inflation.

Nate Kaemingk, world class speaker on inflation and founder of Better Forecasting, offered us his insight on how to prepare for and survive inflation as well as his inflation forecasting in Canada. In this blog post, you’ll learn:

- Why you should identify new profitable sales opportunities for your goods and services

- How to set up an inflation task force

- Why you should adjust your pricing

- Why it’s important to pay attention to uncertainty in demand

- How to understand the financial health of your customers

According to Nate,

“What has worked for your entire career is not necessarily the right answer anymore. Now, more than ever, we need to get ahead of the curve by changing the way we think. There are major corporations out there who have the resources to figure this out but aren’t recognizing the need for change, essentially killing their customer base.”

Let’s dig in and gain expert insight from Nate Kaemingk and be better leaders in all facets of business—no matter the landscape of price stability.

How to Prepare For and Survive Inflation with Nate Kaemingk

ASK YOURSELF: “WHAT NEW OPPORTUNITIES DO WE HAVE FOR PROFITABLE SALES RIGHT NOW?”

Recessive markets create contraction but do not get rid of the inherent demand for consumer spending. We are people who need certain things to survive, be entertained, and live a fulfilling life.

Let’s look at some examples:

- After the 2008 U.S. Recession, Wal-Mart made more money in 2009 than they ever did in the history of the company.

- Amazon tripled their revenue during the pandemic – they went from $10B USD to over $30B USD in 12-18 months.

It’s important to consider what lines you can invest in. What customer base can you serve that you never had the opportunity to before (because their demands are changing)? What can you do differently to take advantage of the market chaos?

SET UP AN INFLATION TASK FORCE

An inflation task force is a select group of people from each of the following focus area functions who report to the CEO or CFO. They are the ones in charge of identifying what needs to change about their functional area as it relates to inflation.

- PRICING

- PURCHASING & INVENTORY MANAGEMENT

- ACCOUNT MANAGEMENT

- ACCOUNTS RECEIVABLES

- R&D AND INNOVATION (If you end up getting excess cash, be sure to put it into inflation-proof investments.)

- LABOR COSTS

ADJUST YOUR PRICING TO REFLECT THE MARKET

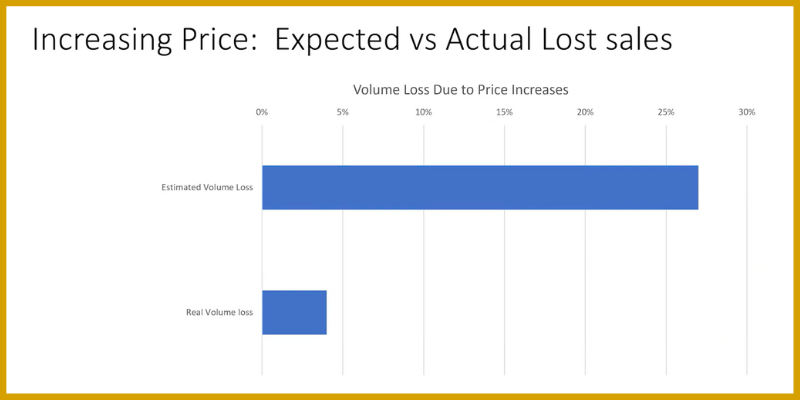

In a recent study by Simon Kucher—pricing strategy advisor to roughly half of Fortune 500 Companies—executives, on average, predicted they would lose 27% of their sales volume as a result of price increase during non-inflationary times. In the end, the real volume loss was only 4%.

Especially amidst the current economic landscape, your customers are expecting a price jump and may even start to question your business if nothing changes. 87% of business have raised prices more than normal because of inflation.

Chart from: Nate Kaemingk

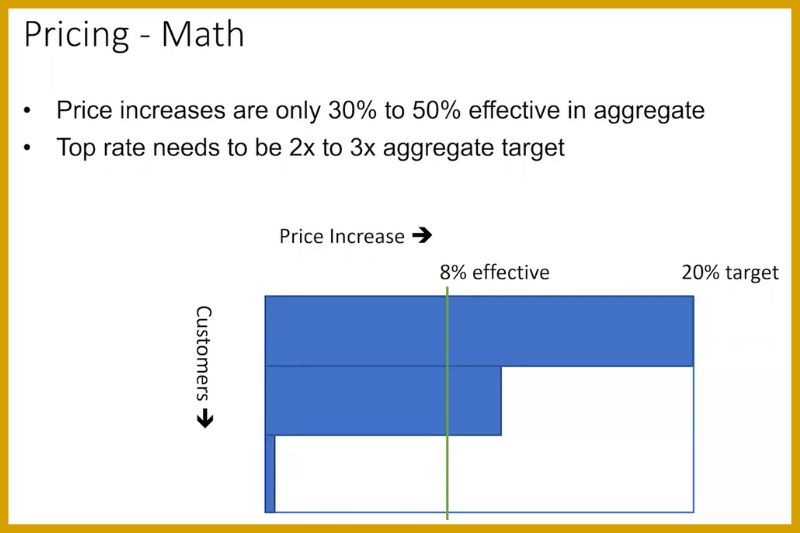

SET YOUR TOP PRICE INCREASE TO BE 2 OR 3 TIMES YOUR AGGREGATE TARGET

Price increases are only 30%-50% effective in aggregate. This means that your overall price increase will be less than your total target because of the response from different categories of customers:

- Customers you have existing contractual pricing agreements with. This can happen when we don’t change our “price-is-good-for” number.

- Customers who understand the need to raise prices, but may negotiate a bit to be able to continually purchase from you.

- Customers who are accepting of the price increase. These customers are usually more focused on quality/convenience over price.

Chart from: Nate Kaemingk

PAY ATTENTION TO UNCERTAINTY IN DEMAND

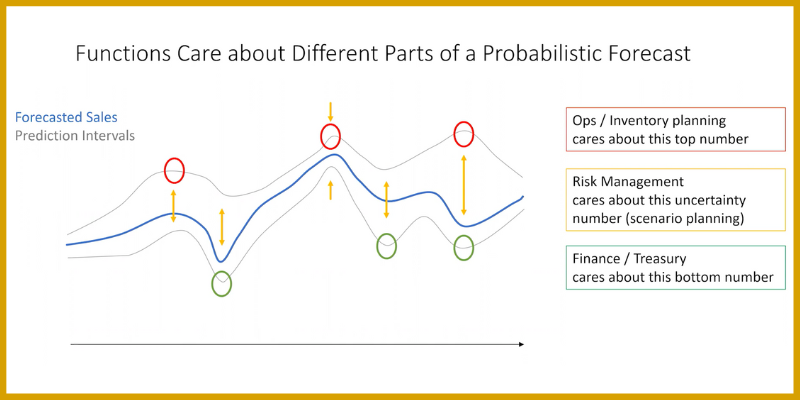

When doing demand forecast and supply chain planning, it’s important to identify and account for areas with more uncertainty than usual, both long term and short term. Each function of a business will watch and prepare for different peaks and valleys of uncertainty.

For example, operations and inventory planning functions will care more about the potential peaks (upside uncertainty) beyond the expected demand. Rather than just always adding an extra “safety net” of inventory throughout the year, learn to characterize when this upside uncertainty is more likely and refrain from keeping extra stock until then. On the other hand, functions like sales and finance might need to prepare more for the potential valleys (downside uncertainty).

Risk management functions, then, will focus on it all to plan for any and every scenario. When a business campaign or strategy goes well once and poor the next time, that will show up in the data as an uncertainty. This means you didn’t execute as well as you did the first time and you have an opportunity to do better. Find ways to identify uncertainty so you can plan around and mitigate the risk.

Chart from: Nate Kaemingk

UNDERSTAND THE FINANCIAL HEALTH OF YOUR CUSTOMERS

The last thing you want is to execute heaps of pricing work, put together the contract, and then see your customer’s company go under because they didn’t do the same kind of pricing work and preparation that you did.

Thank you, Nate Kaemingk, for your insightful and timely information surrounding inflation. With these preparation and research tips, you and your business can assume a resilient and agile position in the market.

Watch Nate’s full presentation on our Deeper Insights Webinar below to learn more about measuring inflation and what you can do to enhance your resilience.