ABOUT TEC CANADA’S CEO CONFIDENCE INDEX

Every quarter, we survey TEC Canada members who are CEOs, KEY Executives, and business owners of small-to-medium enterprises*. The results are then analyzed by Dr. Peter Andersen, the former assistant chief of the Bank of Canada’s research department.

*With employees primarily between 50 to 500 and annual revenue of between $1 million to $500 million.

WHY IT MATTERS

The TEC Canada CEO Confidence Index gathers real-time pulse and sentiment data from Canadian business leaders. This data-driven overview provides insight into the current economic, market, and sector developments and can serve as an early indicator of trends in employment, capital spending, sales, earnings, and profit expectations across the country. By leveraging this information, you can anticipate turning points in economic activity and make informed decisions about your business’s future.

Highlights

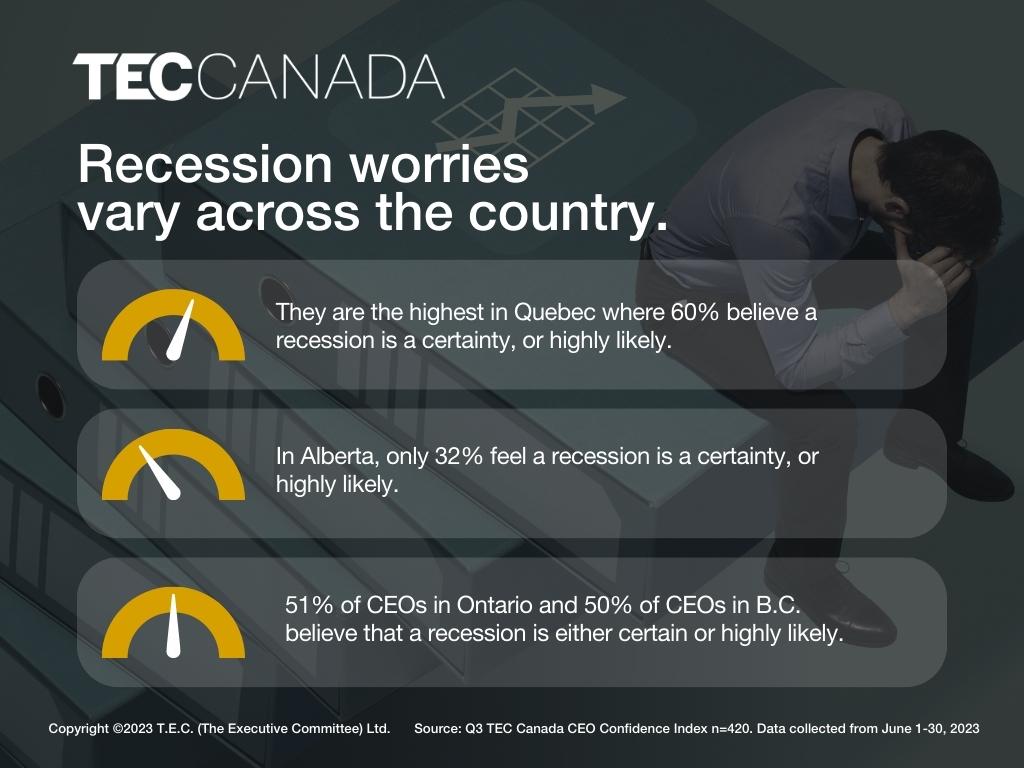

“Almost half of the CEOs surveyed believe that a recession is either a certainty, or is highly likely.” – Dr. Peter Andersen

Featured Insights

The cost and the availability of credit are important items on the worry list. A majority of TEC CEOs & Executives (52%) report that interest rates are having a negative impact on their business. The survey also shows that any further rate increases, from current levels, would increase this to 85%.

As in the previous survey, interest rates are viewed by TEC Leaders as the key trigger factor that could cause a recession. Also, the international banking crisis is making banks more cautious lenders everywhere. Apart from actual interest rates, there is also a credit crunch risk. Lending standards are important for small and medium-sized businesses. The terms and conditions that TEC members are facing have tightened.

Despite these worries about the general economic outlook, the majority of TEC CEOs (52%) still expect to increase their firms’ total number of employees over the next 12 months. This percentage is about the same as in our previous survey. Only 10% expect to reduce their employee headcount.

This is a remarkable finding. The job market is not as responsive to rising interest rates as in the past. The pandemic has changed company behaviour and the demand for labour. CEOs remember the severe labour shortages during the pandemic. They are still prioritizing the need to attract and retain workers.

There are signs that hiring activity is becoming less intense, as a response to rising costs. However, this is not a defining response as almost as many TEC CEOs are telling us that they will not do any cutbacks on active hiring.

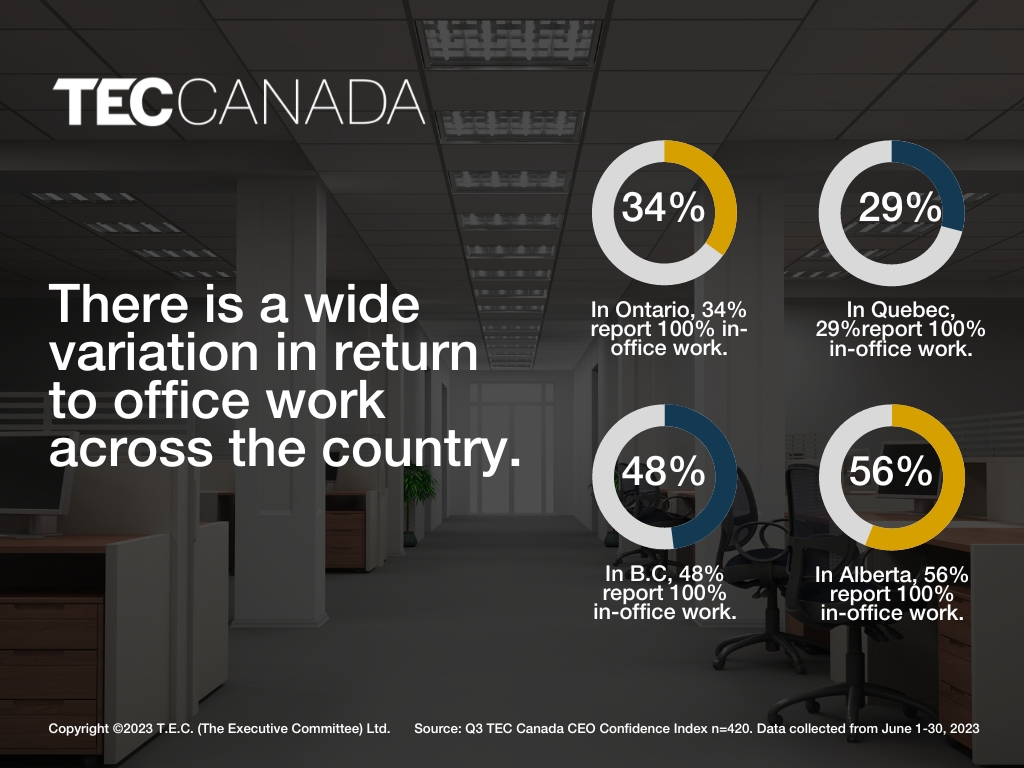

Our survey results show that work from home is here to stay for most TEC members. The majority (60%) indicate some form of hybrid (52%) or full-time remote (8%) work arrangement. Nonetheless, a sizeable national average (40%), does indicate 100% in-office work. It will be interesting to see if these percentages change in future surveys.

There is a wide variation in return to office work across the country. In Ontario, 34% report 100% in-office work. Quebec is the lowest at 29%, and BC and Alberta are running at 48% and 56%, respectively.

Working from home has changed the office space needs of some TEC members. Approximately one in five respondents to our survey indicate a reduction in office space needs, or plans to reinvent their office space. However, almost as many see a need for more office space (15%). This would include more desks and more amenities to attract employees back to the office.

Nonetheless, the bottom line is that a large majority of TEC members (62%) do not believe that there is a reduced need for office space. They are planning to maintain their current space.

As businesses raise prices, employees are demanding higher wages to keep up with the rising cost of living. This creates a wage-price spiral, where higher wages contribute to increased prices, leading to further wage demands – and with a shrinking workforce in Canada, businesses are hesitant to let workers go, driving a sense of job security and more “buying power” for employees.

Despite rising costs and rates, 74% of TEC executives surveyed are not planning on cutting their workforce, and over half are planning on increasing employee headcount. This cycle of price and wage increases perpetuates inflationary pressures and poses challenges for businesses to manage costs while ensuring job security and employee satisfaction.

Download the Report

Unlike other business outlook surveys that only include the largest firms in Canada, our CEO Confidence Index digs deep into what is happening in various provinces, revealing regional trends and providing a unique insight into the challenges and opportunities that matter most to our members.

About Dr. Peter Andersen

Dr. Peter Andersen is an independent consulting economist specializing in economic forecasting. He obtained his doctorate in economics from Harvard University. Early in his career he was Assistant Chief of the Bank of Canada’s Research Department where he advised the Governor and Bank of Canada management on economic conditions and the economic outlook. Later as a partner with a national management consulting firm, Andersen was an economic consultant and advisor to a wide range of companies. He has always emphasized communication and the need to put economic analysis into terms that are useful for business decision-making. Dr. Andersen also spent several years with several major Bay Street investment dealer firms before founding Andersen Economic Research Inc. His clients are widely distributed across a broad range of corporations and financial institutions throughout North America. His objective is to act as a filter, separating the signals from the noise, in order to provide clients with the useful information that they really need.